Arkansas Car Property Tax Rate . Find out how much tax you can expect to pay for your new car. property tax payments for 2023 are due october 15. Property owners can pay their taxes online, in person at the county. calculate state sales tax for my vehicle. the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. all privately owned vehicles are assessed as individual personal property, and many require licensing for use on public. i don't know exactly how the assessed value is derived but it's some percentage of the vehicle value as determined by the. your ad valorem (latin for according to value) general taxes are billed one year behind and are calculated by multiplying.

from www.homeadvisor.com

Property owners can pay their taxes online, in person at the county. calculate state sales tax for my vehicle. all privately owned vehicles are assessed as individual personal property, and many require licensing for use on public. i don't know exactly how the assessed value is derived but it's some percentage of the vehicle value as determined by the. property tax payments for 2023 are due october 15. the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. Find out how much tax you can expect to pay for your new car. your ad valorem (latin for according to value) general taxes are billed one year behind and are calculated by multiplying.

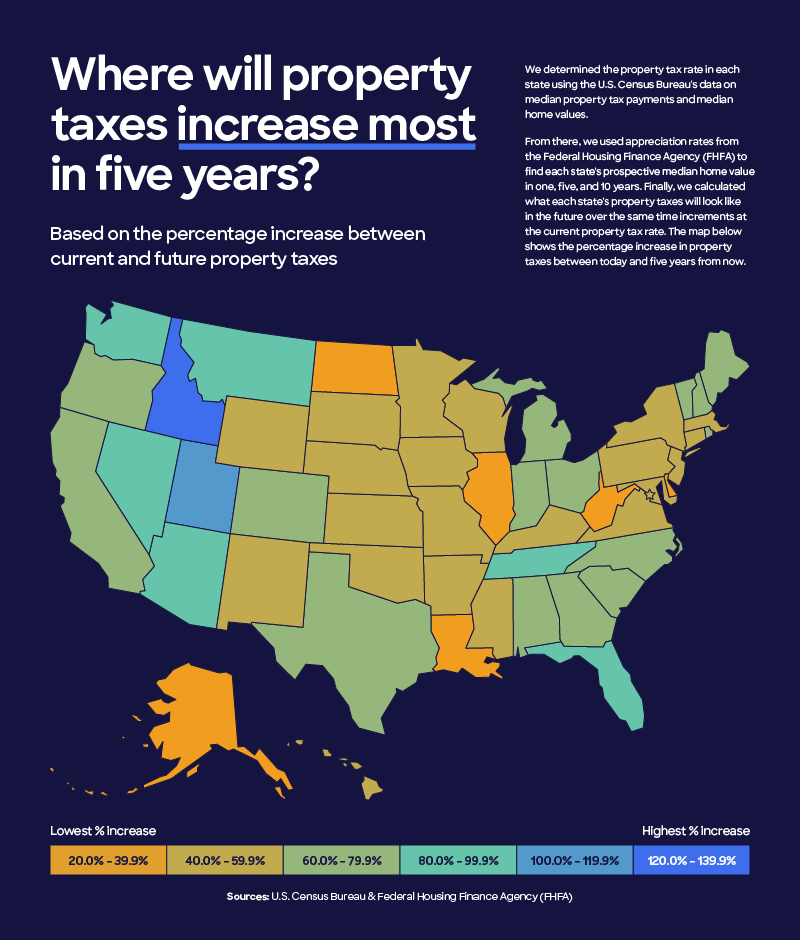

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor

Arkansas Car Property Tax Rate property tax payments for 2023 are due october 15. Property owners can pay their taxes online, in person at the county. the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. Find out how much tax you can expect to pay for your new car. all privately owned vehicles are assessed as individual personal property, and many require licensing for use on public. i don't know exactly how the assessed value is derived but it's some percentage of the vehicle value as determined by the. your ad valorem (latin for according to value) general taxes are billed one year behind and are calculated by multiplying. calculate state sales tax for my vehicle. property tax payments for 2023 are due october 15.

From www.uaex.uada.edu

Arkansas Local Government Resources County government in Arkansas Arkansas Car Property Tax Rate the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. i don't know exactly how the assessed value is derived but it's some percentage of the vehicle value as determined by the. calculate state sales tax for my vehicle. your ad valorem. Arkansas Car Property Tax Rate.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Arkansas Car Property Tax Rate Find out how much tax you can expect to pay for your new car. Property owners can pay their taxes online, in person at the county. property tax payments for 2023 are due october 15. all privately owned vehicles are assessed as individual personal property, and many require licensing for use on public. your ad valorem (latin. Arkansas Car Property Tax Rate.

From joelabhortense.pages.dev

Sales Tax Arkansas 2024 Nert Tawnya Arkansas Car Property Tax Rate the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. Property owners can pay their taxes online, in person at the county. Find out how much tax you can expect to pay for your new car. all privately owned vehicles are assessed as individual. Arkansas Car Property Tax Rate.

From hockeygirlfriendlife.blogspot.com

Arkansas Car Sales Tax Credit State and Local Sales Tax Rates Midyear Arkansas Car Property Tax Rate calculate state sales tax for my vehicle. the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. your ad valorem (latin for according to value) general taxes are billed one year behind and are calculated by multiplying. Find out how much tax you. Arkansas Car Property Tax Rate.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Arkansas Car Property Tax Rate calculate state sales tax for my vehicle. Property owners can pay their taxes online, in person at the county. property tax payments for 2023 are due october 15. your ad valorem (latin for according to value) general taxes are billed one year behind and are calculated by multiplying. i don't know exactly how the assessed value. Arkansas Car Property Tax Rate.

From taxfoundation.org

Arkansas Lawmakers Enact Middle Class Tax Cut Arkansas Car Property Tax Rate i don't know exactly how the assessed value is derived but it's some percentage of the vehicle value as determined by the. Property owners can pay their taxes online, in person at the county. calculate state sales tax for my vehicle. Find out how much tax you can expect to pay for your new car. your ad. Arkansas Car Property Tax Rate.

From www.uaex.uada.edu

New Reports Highlight Arkansas’ Varied Property Tax Landscape Arkansas Car Property Tax Rate property tax payments for 2023 are due october 15. the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. i don't know exactly how the assessed value is derived but it's some percentage of the vehicle value as determined by the. your. Arkansas Car Property Tax Rate.

From www.carsalerental.com

Arkansas New Car Sales Tax Calculator Car Sale and Rentals Arkansas Car Property Tax Rate the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. property tax payments for 2023 are due october 15. all privately owned vehicles are assessed as individual personal property, and many require licensing for use on public. your ad valorem (latin for. Arkansas Car Property Tax Rate.

From gioxepyss.blob.core.windows.net

Used Car Tax In Arkansas at Nicolasa Smith blog Arkansas Car Property Tax Rate Property owners can pay their taxes online, in person at the county. i don't know exactly how the assessed value is derived but it's some percentage of the vehicle value as determined by the. the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas.. Arkansas Car Property Tax Rate.

From www.mortgagerater.com

Arkansas Tax Rate Explained Clearly Arkansas Car Property Tax Rate your ad valorem (latin for according to value) general taxes are billed one year behind and are calculated by multiplying. i don't know exactly how the assessed value is derived but it's some percentage of the vehicle value as determined by the. calculate state sales tax for my vehicle. Find out how much tax you can expect. Arkansas Car Property Tax Rate.

From melindewnanci.pages.dev

Arkansas Tax Tables 2024 Maure Shirlee Arkansas Car Property Tax Rate Find out how much tax you can expect to pay for your new car. property tax payments for 2023 are due october 15. the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. calculate state sales tax for my vehicle. all privately. Arkansas Car Property Tax Rate.

From www.youtube.com

Arkansas State Taxes Explained Your Comprehensive Guide YouTube Arkansas Car Property Tax Rate Find out how much tax you can expect to pay for your new car. calculate state sales tax for my vehicle. your ad valorem (latin for according to value) general taxes are billed one year behind and are calculated by multiplying. all privately owned vehicles are assessed as individual personal property, and many require licensing for use. Arkansas Car Property Tax Rate.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Arkansas Car Property Tax Rate the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. calculate state sales tax for my vehicle. Find out how much tax you can expect to pay for your new car. all privately owned vehicles are assessed as individual personal property, and many. Arkansas Car Property Tax Rate.

From www.youtube.com

Arkansas Property Taxes YouTube Arkansas Car Property Tax Rate the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. your ad valorem (latin for according to value) general taxes are billed one year behind and are calculated by multiplying. all privately owned vehicles are assessed as individual personal property, and many require. Arkansas Car Property Tax Rate.

From www.taxuni.com

Arkansas Property Tax Arkansas Car Property Tax Rate Property owners can pay their taxes online, in person at the county. i don't know exactly how the assessed value is derived but it's some percentage of the vehicle value as determined by the. all privately owned vehicles are assessed as individual personal property, and many require licensing for use on public. Find out how much tax you. Arkansas Car Property Tax Rate.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Arkansas Car Property Tax Rate Find out how much tax you can expect to pay for your new car. all privately owned vehicles are assessed as individual personal property, and many require licensing for use on public. property tax payments for 2023 are due october 15. calculate state sales tax for my vehicle. the table below shows average effective property tax. Arkansas Car Property Tax Rate.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Arkansas Car Property Tax Rate your ad valorem (latin for according to value) general taxes are billed one year behind and are calculated by multiplying. property tax payments for 2023 are due october 15. Property owners can pay their taxes online, in person at the county. i don't know exactly how the assessed value is derived but it's some percentage of the. Arkansas Car Property Tax Rate.

From phaidrawtracy.pages.dev

Arkansas State Sales Tax Rate 2024 Kevyn Merilyn Arkansas Car Property Tax Rate calculate state sales tax for my vehicle. Find out how much tax you can expect to pay for your new car. the table below shows average effective property tax rates, as well as median property tax payments and home values, for every county in arkansas. property tax payments for 2023 are due october 15. i don't. Arkansas Car Property Tax Rate.